Auto Insurance Rates by State.

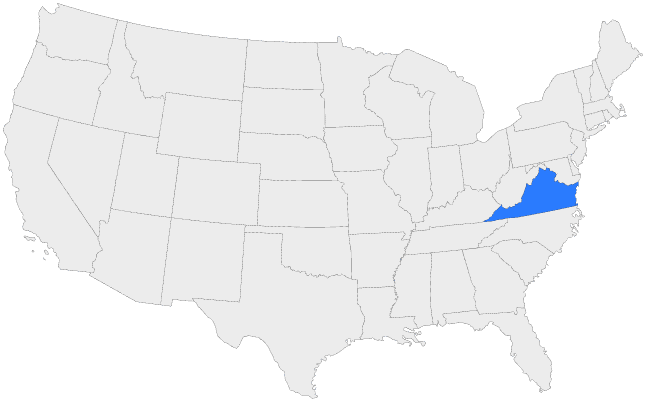

Virginia

![]() Quote Requests Today

Quote Requests Today

46,000 Quotes Provided

![]() Number of Licensed Agents

Number of Licensed Agents

5,000 Agents

- How often should I shop for auto insurance?

- What are the minimum liability insurance limits in Virginia?

If you are more interested in saving money than the service you will get from your insurance company, then you should get quotes every time you are about to renew your insurance. So depending on your insurance company, you should shop for insurance every 6 or 12 months.

| Bodily injury (BI) liability | $30,000 per person / $60,000 per accident |

| Property damage (PD) liability | $20,000 per accident |

| Uninsured/underinsured motorist bodily injury (UM/UIMBI) | $30,000 per person / $60,000 per accident |

| Uninsured/underinsured motorist property damage (UM/UIMPD) | $20,000 per accident |

Auto Insurance Rates in Virginia

Learn more about the driving requirements in your state, how to find the best carrier and compare the lowest rates for your individual coverage needs.

Affordable Auto Insurance in Virginia

May 6, 2022 | Auto Insurance, Virginia

Affordable Auto Insurance in Virginia Whether or not you filed a police report, you must file a Traffic Collision and Insurance Statement with the Virginia DMV if you are involved in a traffic incident in Virginia. You must do this within 72 hours. In addition, you...

Find Top-Rated Insurance Companies In Virginia

All State

(800) 255-7828

Locations Throughout the State

Geico Insurance

(800) 207-7847

Locations Throughout the State

State Farm

(800) 782-8332

Locations Throughout the State

Farmers Insurance

(888) 327-6335

Locations Throughout the State

Nationwide

(877) 669-6877

Locations Throughout the State

Travelers Insurance

(800) 842-5075

Locations Throughout the State

Esurance

(800) 378-7262

Locations Throughout the State

Elephant Insurance

(877) 321-2096

Locations Throughout the State

|

Auto Insurance in Your State |

Company Information

|

Insurance Quotes |

Get In Touch 530 S Lake St #250 Pasadena, CA 91101 |