Auto Insurance Rates by State.

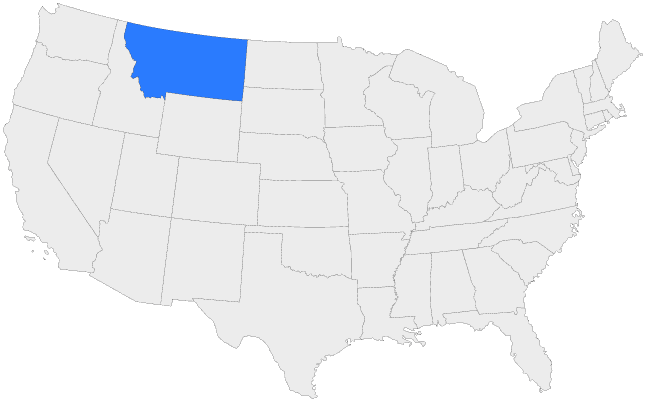

Montana

![]() Quote Requests Today

Quote Requests Today

35,000 Quotes Provided

![]() Number of Licensed Agents

Number of Licensed Agents

3,005 Agents

- What are the required liability limits in the state of Montana?

- Why does my insurance cost more than my agent said it would?

Montana requires you to carry liability insurance with at least the following limits:

$25,000 per person bodily injury;

$50,000 per accident bodily injury;

$20,000 property damage

Determining your premium depends on many factors, including where you live, the kind of car you drive, how much you drive, how much coverage you want, your driving record, and your age.

If an error is made in reporting any of these factors, your rates won’t be quoted correctly. Auto insurance misquotes can happen when your application information differs from your actual driving record.

Companies ask the state’s motor vehicle division to verify the records of the drivers they insure. If you told your insurance agent you have a perfect driving record, and you don’t, your insurance company will charge higher premiums than your agent quotes.

To avoid misquotes, provide accurate information about your driving record and any other factors that could affect the cost of insurance, such as the make of your car or how far you commute to work. Verify all information before signing the application.

Auto Insurance Rates in Montana

Learn more about the driving requirements in Montana, how to find the best carrier, and compare the lowest rates for your individual coverage needs.

Montana Car Insurance Coverage: What Every Driver Needs to Know!

Aug 31, 2023 | Auto Insurance, Montana

Montana car insurance coverage shields every driver from unforeseen road mishaps in the Treasure State. With Montana's vast landscapes and the open road calling, the right coverage ensures both safety and peace of mind. This guide walks you through everything you need...

Unlocking the Best Deals: Your Ultimate Guide to Montana Auto Insurance Quotes

Jun 8, 2023 | Auto Insurance, Montana

Introduction If you own a car in Big Sky Country, having the right auto insurance isn't a suggestion - it's a legal obligation. Various insurance companies provide different coverage options, making the search for the best Montana auto insurance quote that suits your...

Auto Insurance Montana

Feb 20, 2023 | Auto Insurance, Montana

Auto Insurance in Montana An auto insurance Montana policy is a contract between you and the insurance provider that secures you against loss of money in the case of an accident or theft. This contract protects you against financial loss if an accident or theft...

Auto Insurance in Montana

Oct 20, 2022 | Auto Insurance, Montana

Car Insurance in Montana Montana law says that drivers must keep proof of insurance in their car and show it to police if they ask. In Montana, it is a misdemeanor to drive without car insurance. Montana has an online verification system to ensure drivers have the...

What Do I Need When Getting a Quote?

If you currently have insurance, we recommend you have your current Dec Page. The Dec Page has all your current information such as current coverage, pricing, and vehicle details. If you don't have insurance, you need your car information (Make, Model, and VIN), your and all driver information (date of birth and license number), and the type of insurance you need (basic liability, full coverage, higher limits).

- Insurance Quotes

- Auto Insurance

- Medicare

- Resources

- Insurance by State

Compare Quotes Instantly.

Enter your zip code, answer a few questions, and compare insurance quotes online in less than 3 min.|

Auto Insurance in Your State |

Company Information

|

Insurance Quotes |

Get In Touch 530 S Lake St #250 Pasadena, CA 91101 |