Auto Insurance Rates by State.

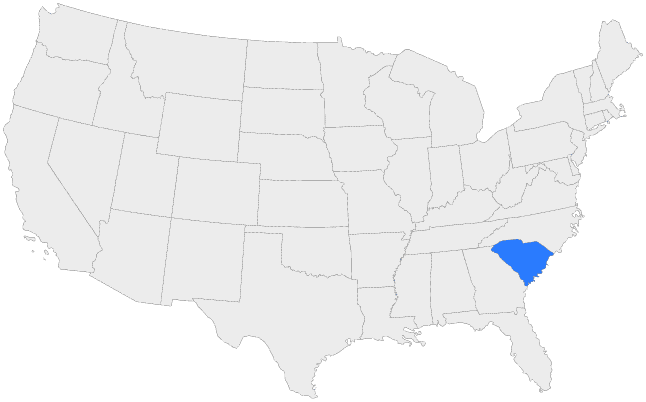

South Carolina

![]() Quote Requests Today

Quote Requests Today

50,500 Quotes Provided

![]() Number of Licensed Agents

Number of Licensed Agents

Over 5,000 Agents

South Carolina requires you to carry a minimum of $25,000 per person for bodily injury and $50,000 for all persons injured in one accident, and $25,000 for all property damage. South Carolina law also requires you to carry uninsured motorists’ coverage equal to the minimum liability coverage (25/50/25). There is typically a $200 deductible.

Each company adopts its own rating system, although there are general guidelines that all companies follow.

The single greatest influence on the rating process is claim frequency. This does not mean how many times you specifically have made an insurance claim, although that will have an additional effect. Claim frequency measures how often an insured event occurs within a group relative to the number of policies in that group. In general, persons sharing characteristics with high claims groups will be charged more for insurance coverage.

Auto Insurance Rates by State

Learn more about the driving requirements in your state, how to find the best carrier and compare the lowest rates for your individual coverage needs.

Best Car Insurance Companies in South Carolina

Dec 23, 2022

Finding the cheapest cost for auto insurance is less crucial than finding a reliable provider. We can help you find the best car insurance companies in South Carolina. Where you live significantly impacts how much you pay for auto insurance. Cities with a high...

What Do I Need When Getting a Quote?

If you currently have insurance, we recommend you have your current Dec Page. The Dec Page has all your current information such as current coverage, pricing, and vehicle details. If you don't have insurance, you need your car information (Make, Model, and VIN), your and all driver information (date of birth and license number), and the type of insurance you need (basic liability, full coverage, higher limits).

- Insurance Quotes

- Auto Insurance

- Medicare

- Resources

- Insurance by State